Regional differences exist when it comes to what c-store customers consider healthy.

By Tim Powell

Two decades ago it would have seemed ridiculous to consider finding a healthy item in a convenience store. Convenience store shoppers have historically looked to these venues for cigarettes, frozen slushees, beer and Slim Jims.

However, this is no longer the case. Today’s c-store shoppers across the country actually expect prepared sandwiches and salads with better-for-you (BFY) features, such as fresh, low-calorie, organic, all-natural and preservative-free.

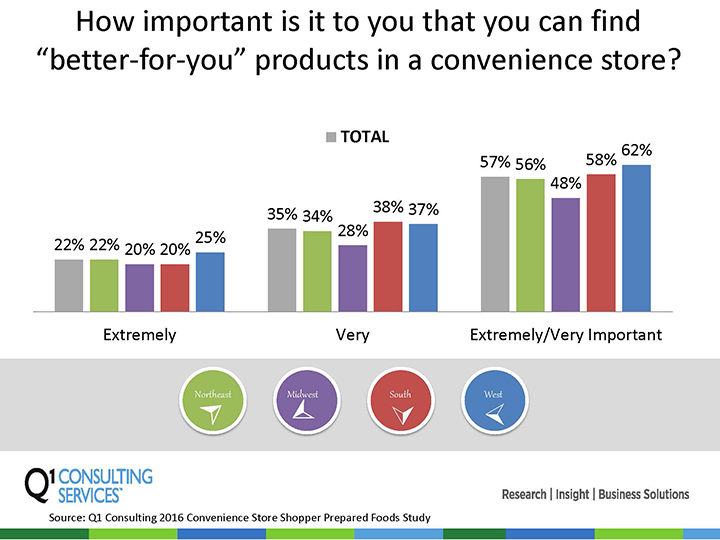

Finding BFY in convenience stores, on average, is important to 57% of convenience store consumers. Consumers on the West Coast, however, tend to place a higher importance on finding BFY products (26%) compared to all U.S. regions. The Midwest, by contrast is less concerned about finding BFY products, and only somewhat concerned with (33%) finding healthier items, implying a sense of indifference compared to the remainder of the U.S.

FRESH EQUALS HEALTHY

Over the past decade, the word “fresh” has been blanketed on menus, menu boards, restaurant signs and taglines. From there, “all-natural” and “low-calorie” are the second and third most-associated terms with BFY.

However, certain BFY characteristics differ by region when looking beyond the top five features. Consumers in the Northeast consider organic and sugar-free important, while the West places emphasis on preservative-free items. Consumers in the Midwest tend to consider what is in their foods by appointing high protein as an important BFY feature. And in the South, consumers are most likely to view sugar-free as a top BFY characteristic.

REGIONAL DIFFERENCES

Convenience store shoppers were asked what items with BFY features they had purchased at a convenience store. The top overall BFY features included fresh, prepared fresh on-site, low-calorie, sugar-free and low-fat; however, purchase behaviors varied widely by region.

The Northeast Favors Low-Calorie, Snubs Added Vitamins: Convenience store shoppers in the Northeast over-indexed on low-calorie, low-fat and gluten-free BFY features but were markedly lower than average on their interest in added vitamins and minerals.

Organic, All-Natural Registers Lower in the Midwest: Many of the BFY factors of items purchased in the Midwest align with the national average, with the exception of all-natural, organic and calorie-free.

The South Reflects the National Average: Few factors influence shoppers in this region. Low-fat is the single most notable shift for this region compared to the average (over-indexes by two percentage points).

Sourcing is the Most Influential BFY Component in the West: “Organic,” “all-natural” and “clean-label” are all terms that influence shoppers in the West compared to the national average. Shoppers in the West are also less likely to be influenced by low-calorie, sugar-free and items prepared fresh on site.

The U.S. restaurant industry has long been creating healthier options, be it smaller plates or non-GMO ingredients. As a result, the demand for BFY products has hit convenience stores and is no longer confined to the coasts.

Stakeholders—including retailers and food manufactures—will likely gain the most from marketing their items’ BFY features, touting what appeals to their consumer base.

Tim Powell is a senior analyst at Q1 Consulting, based in Chicago. He can be reached at [email protected].