Data shows customers are turning to still and sparkling water and ready-to-drink coffees over traditional soft drinks as beverage trends evolve.

By Brad Perkins, Contributing Editor

There used to be only a few beverage options in convenience stores: Coffee, tea, soda and water. Variations included cream and sugar or Coke versus Pepsi.

And nobody cared about ingredients. They simply wanted refreshment when they were thirsty and stopped in for something cold or hot.

“Beverages are often an impulse purchase in many buying decisions, which makes convenience stores a prime channel for them,” said Gary Hemphill, managing director of research at Beverage Marketing Corp. (BMC).

But like other sectors, tastes changed. People began to both demand more from their beverages and move toward healthier options. And that brought the introduction of new variations of packaged beverages: Ready-to-drink (RTD) coffee, flavored water, energy and sports drinks. With fruit flavors, vitamins and electrolytes enticing them to the cold vault, people began to choose packaged beverages so often, the category began to outpace many other categories.

“I think customers are looking for healthier options,” said Melissa McPherson, category manager at NOCO Express, which operates 39 locations in western New York. “They want more than just something to drink; they want something they can feel good about drinking.”

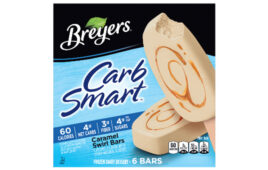

And the statistics back that up. A National Association of Convenience Stores (NACS) study showed that, in 2017, packaged beverages represented 16% of sales contribution and 20% of gross profit contribution across all convenience store channels, with sales of $128 million. And their sales margin of 42% was higher than the 22% for beer and 14% for cigarettes. Among other convenience store segments, it trailed only health/beauty care, candy, snacks and ice cream.

One main reason is bottled water. It is the top-selling beverage in the U.S., with sales of 13.7 billion gallons in 2017, according to a BMC study. The study showed that bottled water sales increased 8.8% to $18.5 billion and per capita consumption passed 42 gallons.

“We continue to see healthy growth in bottled water and many of the newer niche categories, while some of the tried and true traditional categories are struggling,” Hemphill said. “Sodas, coffee and water are all essential categories, but water is performing the best.”

Water, in fact, was one of the main drivers of a 5% growth in non-alcoholic beverage sales from Labor Day 2017 through Labor Day 2018, according to Beverage Buzz Surveys. The other drivers were energy and sports drinks.

“There are a few trends we have been seeing,” McPherson said. “First is growth with more natural products. We have seen a shift toward bottled water—still and sparkling. Customers are reading labels and looking for the healthier options to what they had been drinking, like BodyArmor versus Powerade.”

BodyArmor’s brand has grown because of its healthy reputation. And even in water, brand recognition can help. But so do taste and flavor. BMC data showed that value-added water grew 17% in 2017. And much of that is because of companies like LaCroix, Polar and Bubly adding innovative—and traditional—flavors to the market of sparkling water.

“In the sparkling segment, the name recognition of brands like Polar, Poland Spring and Schweppes have helped,” McPherson said. “Bubly has had a bit slower sales, but is starting to get some traction.”

NEW COLA WARS

Health-consciousness and providing an alternative to soda is triggering something not seen since the 1980s: The Cola Wars. Call it Cola Wars Part 2: the healthier beverage edition.

“Health and variety demands are the two most significant trends impacting people’s beverage choices today,” Hemphill said.

With BMC data showing year-over-year growth in volume for sports drinks of 1.78% in fiscal year 2017 and 7.25% for energy drinks, it’s no wonder the big companies want a piece of the action. That has led Coca-Cola and Pepsi to battle in water, energy drinks and sports drinks.

“Energy is our best segment, [even though] our largest growth has been with the waters,” McPherson said. “Customers really need to have that burst of energy to keep them going throughout the day.”

Coca-Cola recently made a move to enhance its standing against Pepsi-owned Gatorade. It purchased a stake in BodyArmor, which is not only a competitor of Gatorade—and its own Powerade—but touts having less sugar and more electrolytes than its more well-known competitors.

HAVE CAFFEINE?

Not to be outdone by non-caffeinated beverages, coffee’s appearance in the packaged beverages sector is also growing. While people still want fresh-brewed coffee, ready-to-drink (RTD) coffee drinks have increased in options and consumption in recent years. A study by market research firm Mintel showed that RTD coffee is the fastest growing portion of the coffee industry, increasing 31% since 2016.

With total U.S. coffee retail sales expected to pass $14 billion this year, RTD is a force. And it’s not just one company.

“A lot of customers think Starbucks when they think iced coffee,” McPherson said. “And yes, Starbucks has always been a leader in this segment, but they are starting to see more competition. Dunkin’ and Caffe Monster are starting to make a bit of noise.”

That noise has led to year-over-year growth rates in the double digits for RTD coffee between fiscal years 2011-2016 and single-digit growth in 2017, according to Beverage Marketing Corp. And the new Cola Wars are beginning to seep into the space, too. Coca-Cola recently purchased Costa Coffee, giving it inroads in European coffee markets, but also increasing its RTD profile.

But packaged beverages are not all about the national (or international) brands. With the popularity of the category comes local options, too. As in other beverage categories, offering locally-made products can bring in customers.

“We have added a locally-brewed Kombucha into several of locations and have a locally- produced sugar-cane soda available in some stores, McPherson said. “Keeping that local connection is really important to us.”

What is most important in this segment is customer desire. And it seems that customers’ desire for water, sports drinks, energy drinks and coffee will continue their upward trend, providing many more options than previously were available at a fast stop in the convenience store.

“When we realized the shift in consumer habits, we reimagined our vaults to add emphasis on the growing segments,” McPherson said. “We decreased space that was traditionally allocated to carbonated soft drinks. This allowed us to add space to energy and water.”