C-store salty snack sales continue to grow as customers reach for better-for-you and spicy chips, and ready-to-eat popcorn.

Between 2013 and 2018 annual purchases in the U.S. potato chip market grew from $8.5 billion to $9.6 billion, according to research firm Euromonitor International.

If there is a change afoot, it may be customers’ increasing preference for spicier-flavored chips, as well as good-for-you chips made from vegetables, black beans, chickpeas, lentils and other healthy ingredients not traditionally found in snack chips.

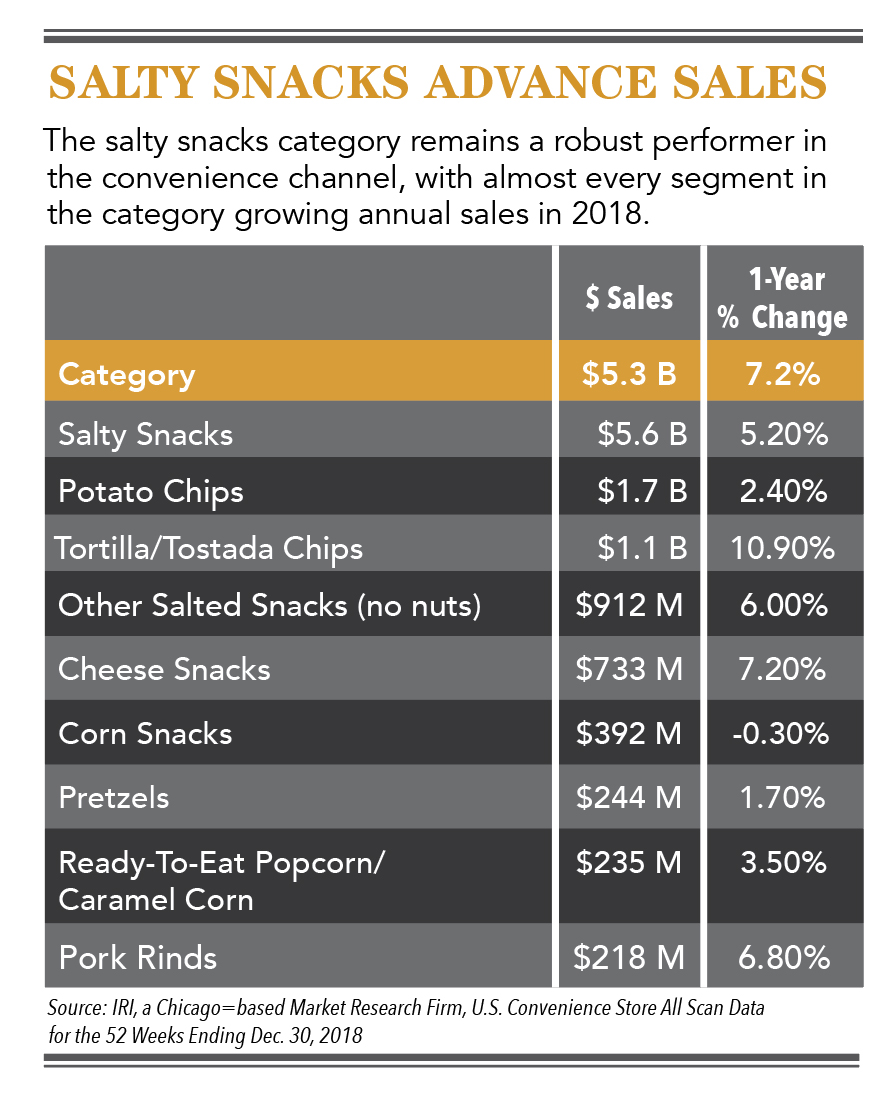

Salty snack sales are expected to continue increasing, topping $13.6 billion by 2021, Mintel research indicated. Aside from a growing variety, the overall sales growth in the salty snack category is expanding through the introduction of popcorn, followed by cheese snacks and corn snacks.

Ready-to-eat (RTE) popcorn is a rapidly growing salty snack option due to its convenience, healthy halo and overall category innovation, Mintel reported.

Chips are likely benefiting from the growing tendency of customers to buy snacks at c-stores. The percentage of customers who bought snacks in c-stores grew to 36% from 31% between 2014 and 2017, and is projected to increase to 37% in 2019, according to Jeff Lenard, vice president, strategic industry initiatives for the National Association of Convenience Stores (NACS).

EXPERIMENTAL CONSUMPTION

At Zarco USA stores in Lawrence, Kan., CEO Scott Zaremba sees customers increasingly trying out new chip flavors. “A lot of our customers are asking for spicier chips, and ones with more flavor and different spices.”

“They’re trying them, and then going back to their standard, then trying the next new one that comes out. They might try Doritos Lime, go back to Nacho Cheese, and try the next flavor introduced,” Zaremba said. “They’re searching for flavorful chips, asking for them, perusing the aisles. It will be interesting to see what becomes the new standard.”

Frito-Lay chips are No. 1 at Zarco USA stores. A Lay’s plant stands about 20 miles away, so that leading brand is a natural for Lawrence-area stores, Zaremba said.

Salty snacks are always merchandised near the beer cooler in the back of the stores. “But we’ve begun moving them to non-traditional places, to see if we can introduce new sales for this grab-and-go item,” Zaremba said. “In the chip world, there is always something new, and when there are introductions of new products, new labels and new items, we like to have them at the front of stores to make them look fresh and ever-changing. We’ll have them in multiple places within the store.”

More convenience chains are seeing success with their own private-label salty snacks. Yesway, with 150 stores in nine states, recently introduced a new private-label line. 7-Eleven also has an extensive line of private-label chips. Lenard said such innovations allow a chain to focus more on value-added opportunities and have more latitude to tell a brand story.

Chips are a natural item for cross-merchandising. Zarco USA stores have cold and hot grab-and-go selections, and chips are merchandised along with those items.