According to a new report by Grand View Research Inc., the global hot drinks market size is expected to reach USD 397.3 billion by 2025, expanding at a CAGR of 6.8%.

According to a new report by Grand View Research Inc., the global hot drinks market size is expected to reach USD 397.3 billion by 2025, expanding at a CAGR of 6.8%.

Hot drinks help in reducing the prevalence of various lifestyle related diseases such as blood pressure, obesity and stress. Increasing awareness of the health benefits among the young consumers is expected to drive the market over the forecast period.

Key suggestions from the report:

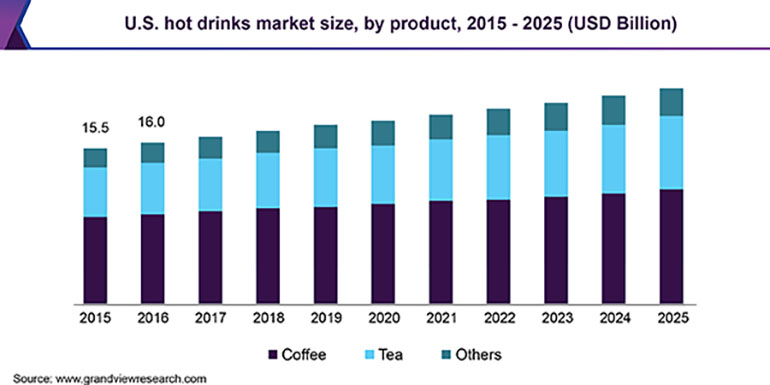

- By product, coffee dominated the global market with a revenue share of 42.7% in 2018. Tea is anticipated to ascend at a CAGR of 7.6% over the forecast period.

- Asia Pacific dominated the global hot drinks market in 2018 and is expected to expand at the fastest CAGR of 7.9% over the forecast period. This trend is projected to continue over the next few years.

- The industry is highly competitive, with leading players including Costa Coffee; Starbucks; Celestial seasoning Inc.; Caffe Nero; and Ajinomoto General Foods Inc.

- Various manufacturers are concentrating on new product launches, capacity expansion and technological innovation to estimate existing and future demand patterns from upcoming product segments.

The vendors are launching various ready to make drinks with various flavors and aromas to attract young consumers. Increasing product availability and retail outlet is driving the market for hot drinks over the forecast period.

Furthermore, manufacturers are adopting various food safety regulations such as GRAS, Kosher, HACCP, USDA Organic, and GMP to ensure delivery of quality product and to attract larger customer base.

Increasing prevalence of various lifestyle related diseases in both developing and developed countries has led to an increase in consumer interest in healthier products, thereby providing growth opportunity for hot drinks over the forecast period.

It has been surveyed that hot green tea is known to be very healthy, which helps to increase the metabolism and weight loss. Furthermore, herbal tea helps in detoxification and relieving stress, which is expected to fuel demand for tea over the forecast period.

Coffee dominated the market in 2018 and is expected to maintain its lead over the forecast period. Increasing penetration of organic coffee and coffee pod is a key factor fueling the demand for coffee over the forecast period.

Tea is expected to see significant growth over the forecast period. Increasing launch of flavored and aroma tea is driving the interest of young consumer.