The salty snack category in the last few years has experienced a resurgence with new products and healthier options.

The salty snack category in the last few years has experienced a resurgence with new products and healthier options.

In its “Salty Snacks: U.S. Market Trends and Opportunities” report published prior to the COVID-19 pandemic, Packaged Facts forecast that dollar sales of salty snacks in the U.S. will grow at a compound annual rate of 4%, reaching $29.3 billion in 2022.

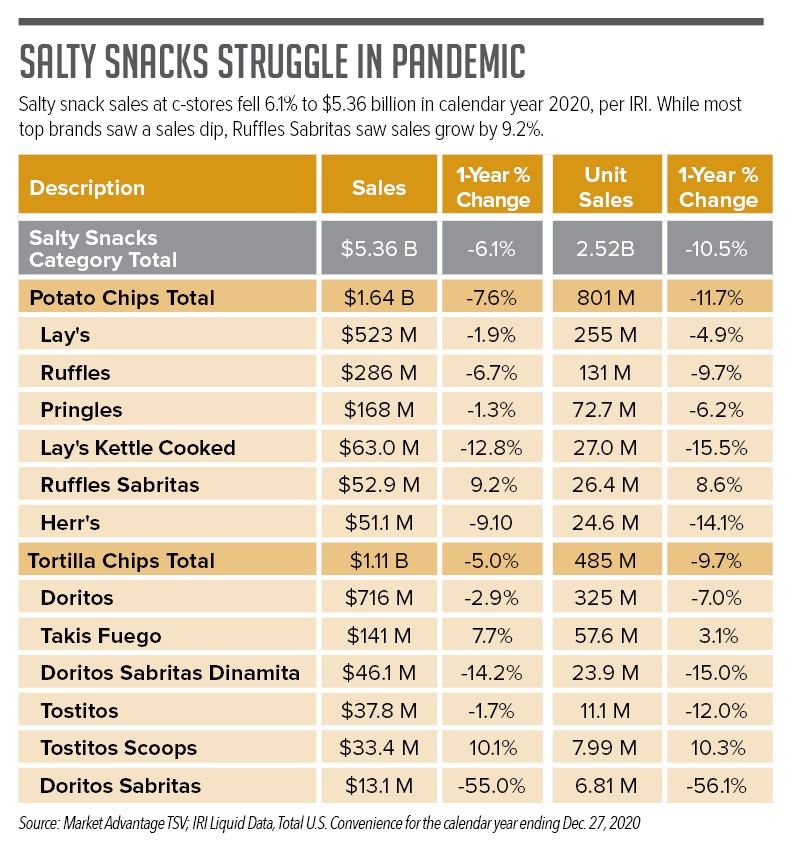

However, the pandemic took its toll on sales in 2020, according to market research firm IRI. For the 2020 calendar year, IRI reported salty snack sales fell 6.1% overall as a category, due to reduced store visits during the pandemic. Sales still totaled a solid $5.3 billion.

The two biggest segments of salty snacks — potato chips and tortilla chips — saw dollar sales decline in the convenience channel 7.6% and 5.0%, respectively. Despite the reduced store traffic, potato chips managed to ring up $1.64 billion in sales, while tortilla chips sales totaled $1.11 billion.

Retailers remain optimistic that sales will snap back in this key category as store visits continue to increase.

“The COVID-19 pandemic created unique challenges for the convenience store industry. Store visits were down, but market baskets were up for the year,” said Greg Ehrlich, president of Friendship Kitchen, the retail division of Beck Suppliers, which operates nearly 30 stores in Ohio. “As we move forward in 2021, we remain optimistic that all categories, including salty snacks, will see sales and volume increases to pre-COVID levels and beyond.”

Looking Forward

A number of convenience stores continue to dedicate considerable shelf space to salty snacks, but also use temporary floor displays and wing-like fixtures on aisle end cap shelving to offer and expand on their salty snack selection throughout the store. The more placements, the better.

Innovative flavors, healthier options and protein snacks are expected to remain on trend in this category for the foreseeable future, as consumers seek more nutritious meal replacement options without sacrificing flavor. Spicy and hot flavors are also expected to remain popular, and the numbers seem to bear that out, according to IRI. In the potato chips segment, Ruffles Sabritas was the only product in the top 10 brands to show sales gains in the pandemic, jumping 9.2% to $52.9 million. Unit sales increased 8.6% to 26.3%.

Similarly, in the tortilla chip segment, Takis Fuego became the No. 2 top-selling brand, with a 7.7% increase in sales to $141 million in 2020, behind only Doritos, which suffered only minor sales loses of 2.9%, while still posting an impressive $716 million in sales in the convenience channel, according to IRI.