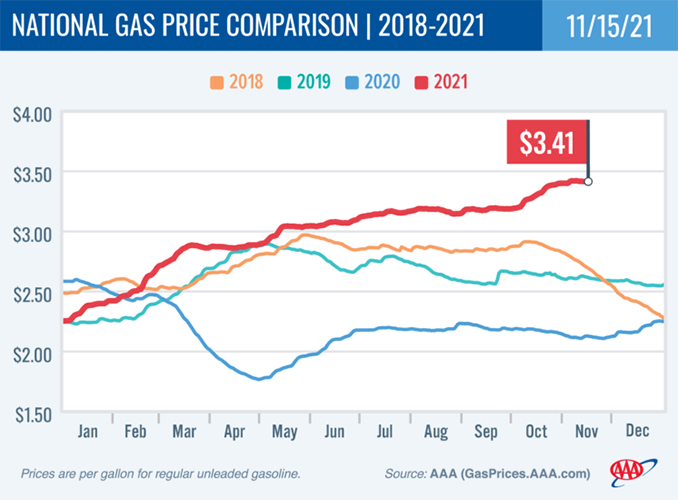

The national average price for a gallon of gas leveled off at $3.41, down a penny since last week, according to AAA. Since Oct. 30, the national average has fallen on nine different days, after having risen steadily each of the previous 31 days.

The national average price for a gallon of gas leveled off at $3.41, down a penny since last week, according to AAA. Since Oct. 30, the national average has fallen on nine different days, after having risen steadily each of the previous 31 days.

“A slight dip in gas demand, possibly due to seasonal driving habit changes, is contributing to some price relief at the pump,” said Andrew Gross, AAA spokesperson. “Unfortunately, the ongoing tight supply of crude oil will likely keep gas prices fluctuating, instead of dropping, for some time.”

According to new data from the Energy Information Administration (EIA), total domestic gasoline stocks decreased by 1.6 million bbl to 212.7 million bbl last week. Gasoline demand dropped from 9.5 million b/d to 9.26 million b/d. This drop coupled with an increase in the domestic crude oil supply caused downward pressure on prices. However, pump prices will likely remain elevated for consumers as long as oil prices are above $80 per barrel.

Today’s national average of $3.41 is 11 cents more than a month ago and $1.29 more than a year ago, and 81 cents more than in 2019.

Quick Stats

Quick Stats

The nation’s top 10 largest weekly changes: Arizona (+7 cents), California (+6 cents), Pennsylvania (+4 cents), Illinois (−4 cents), Oklahoma (−4 cents), Indiana (−4 cents), Delaware (−4 cents), Ohio (−4 cents), Michigan (−3 cents) and South Dakota (−3 cents).

The nation’s top 10 most expensive markets: California ($4.68), Hawaii ($4.34), Nevada ($3.97), Washington ($3.87), Oregon ($3.78), Alaska ($3.71), Utah ($3.70), Idaho ($3.69), Arizona ($3.66) and Washington, D.C. ($3.62).

Oil Market Dynamics

At the close of Friday’s formal trading session, WTI decreased by 80 cents to settle at $80.79. Crude prices decreased slightly last week as inflation fears weighed on the market. Additionally, prices also fell after EIA reported that the total domestic crude supply increased by 1 million bbl to 435.1 million bbl last week.

However, according to EIA’s data, the total domestic crude supply is still down 11% compared to the previous year at this time, helping to keep elevated price pressure on crude. For this week, crude prices could decrease again if EIA’s next weekly report shows another crude inventory increase.