Despite a challenging 2020, vape sales have persevered.

Despite a challenging 2020, vape sales have persevered.

The National Association of Convenience Stores (NACS), in conjunction with several other retail associations, has called on the federal agency to release the list so c-stores can be in compliance by pulling the MDO products. At the moment, the FDA cites confidential commercial information concerns as reason for not disclosing the information. Rather, it recommends retailers confer with manufacturers for their MDO specifics.

“The FDA’s repeated bungling of vaping product regulation has made it incredibly difficult for industry transformation to be anything more than a tagline,” said Gregory Conley, president of the American Vaping Association.

He also expressed concerns that healthy state budgets could embolden more lawmakers to push for flavor bans because coffers aren’t as reliant on tobacco tax revenue right now.

“Congress has allocated more than $500 billion to state and local governments in the last year because of COVID-19, with little in the way of restrictions on how that money can be used,” said Conley. “As a result, total bans on the sale of all flavored tobacco and nicotine products, including menthol cigarettes, could take further hold in the Northeast and states like Colorado and Oregon.”

Sales Trend Upward

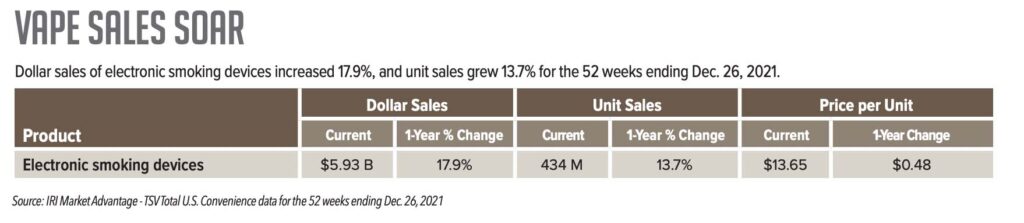

While legislators and industry leaders battle on these issues, stores continue to appreciate the fact that this nicotine subcategory keeps posting gains. IRI recorded nearly $6 billion from sales of electronic smoking devices in c-stores for the 52 weeks ending Dec. 26, 2021, representing an almost 18% gain. Volume also posted double-digit growth.

“While the cigarette category may be declining, vape and OTP is increasing due to a myriad of tobacco options for the customer. For instance, we saw a 54% increase in Vuse in 2021,” said Nathan Arnold, director of marketing for Englefield Inc. The family-owned company runs 119 Duchess c-stores throughout Ohio and West Virginia.

“We followed customer trends and introduced some new brands and options for our customers,” he added. “New introductions, like BIDI Sticks, contributed to 3% of the sales growth in this category.”

For now, category managers find themselves in the all-too-familiar position of waiting to see if additional federal regulation will disrupt the vape/e-cigarette segment again. Until then, they hope vape sales will follow the current profitable pattern.