After a multi-year volume decline, carbonated soft drinks (CSDs) rebounded in 2021 due to foodservice sales increasing post-2020, according to Gary Hemphill, managing director of research at Beverage Marketing Corp.

After a multi-year volume decline, carbonated soft drinks (CSDs) rebounded in 2021 due to foodservice sales increasing post-2020, according to Gary Hemphill, managing director of research at Beverage Marketing Corp.

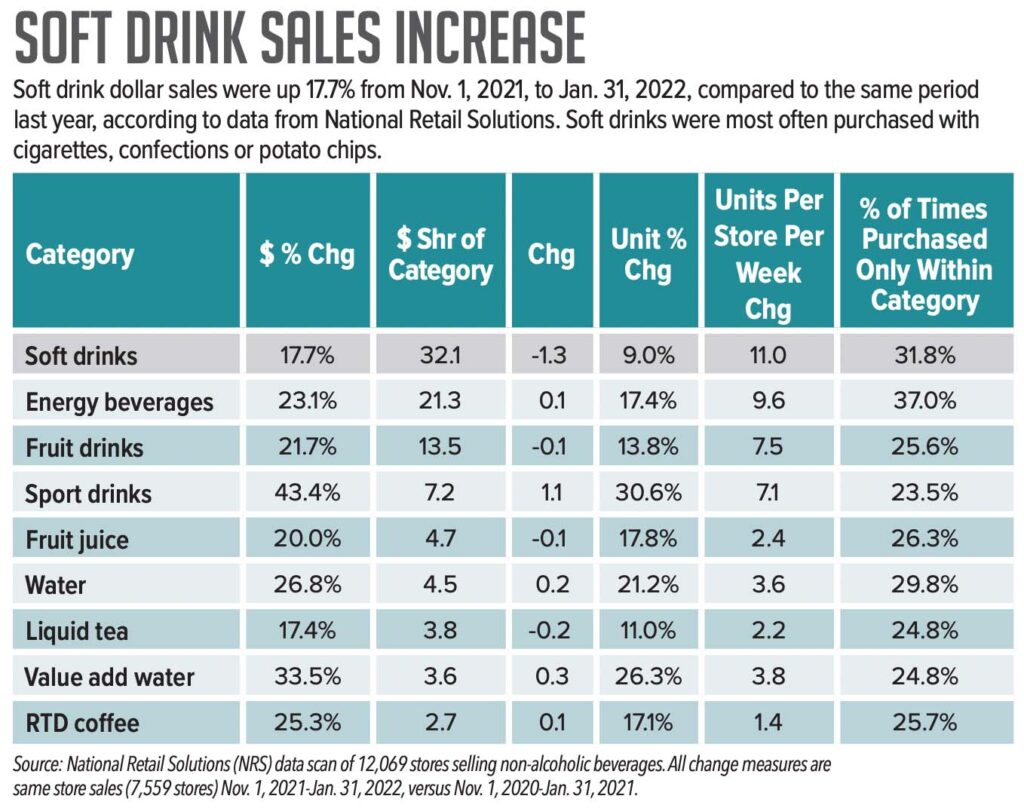

Dollar sales for carbonated beverages increased by 7.3% for the 52 weeks ending Dec. 26, 2021, according to IRI convenience store data.

Soft drinks saw dollar sales of $8.63 billion, up 4% for the 52 weeks ending Jan. 29, 2022, according to Total U.S. Convenience data from NielsenIQ.

A top performer of the carbonated beverage category in 2022 is expected to be sparkling water, which has seen dollar sales steadily rise year after year, Hemphill noted.

Sparkling water dollar sales rose 20.4%, totaling $267 million in convenience stores for the 52 weeks ending Jan. 29, 2022, per NielsenIQ. Seltzer water totaled $32.4 million, up 6.8%.

“Consumer demand for healthier sparkling refreshment has boosted the sparkling water category,” said Hemphill.

When it comes to traditional soft drinks, despite rising dollar sales, not all c-stores foresee growth for the category in 2022, as competition in the cold vault and customers’ penchant for healthier options continues.

Eric Patterson, merchandising manager at Flint, Mich.-based Beacon & Bridge Market, commented that soft drinks, despite being a store staple, are not expected to be granted expanded space in Beacon & Bridge’s 25 stores.

However, he noted that CSDs are “still the workhorse category for (its) vaults.”

Patterson noticed that watermelon seemed to be a trending flavor for soft drinks.

“Anything watermelon is on fire! A few years ago, it was mango everything; today, it’s watermelon. We’ve seen good success with Mt. Dew Major Melon, Watermelon Monster and Watermelon Red Bull,” he said.

He also pointed out Pepsi’s successful strategy with Mountain Dew limited-time offers.

New Brands and Innovation

Hemphill expects to see new innovation surrounding CSDs and other sparkling beverages, particularly functional innovation.

“One example is the increasing numbers of pre- and probiotic sparkling drinks that have emerged on the market,” he said, referring to recent innovation.

He also anticipates seeing an increased blend between traditional refreshment brands and alcohol, provided the combinations already in the market are successful.

Patterson noted that innovation can be successful, particularly for consumers in more densely populated areas who “are more apt to try something new.”

Additionally, Patterson suggested that carrying new brands would help boost the category.

Beacon & Bridge plans to add brands to its portfolio with the hopes that consumers who typically lean toward cold dispensed beverages might convert to refrigerated beverages, especially because Patterson expects cold dispensed beverage sales, which have been down at his stores since the start of the pandemic, to continue to trend downward.

“With all the pipeline disruptions we’ve seen,” he said, “I really think this is going to be the time for ancillary brands to shine.”